Shanghai Baosteel Packaging

(601968 CH)

加速東南亞佈局,國企資源優勢逐步顯現

Accelerating buildout into Southeast Asia; emerging SOE resource advantages

BUY (maintain) |

投資要點/Investment Thesis

投资要点/Investment Thesis

公司發布半年報,23Q2實現營業收入20.29億元,同增2.35%,實現歸母淨利潤0.66億元,同減8.82%,實現扣非後歸母淨利潤0.61億元,同減11.46%;23H1實現營業收入37.89億元,同減1.22%,實現歸母淨利潤1.27億元,同減6.74%,實現扣非後歸母淨利潤1.2億,同減9.05%。上半年收入增速略承壓,Q2增速回正,主要受行業市場競爭加劇,原材料價格波動以及巨集觀經濟影響下游需求不及預期等影響。23H1經營活動產生的現金流量淨額6.9億,同比大幅改善,同增343.49%,主要系本年度應收賬款ABS項目提前回款應收客戶貨款7.3億。

H1 net profit fell 6.7% yoy on intensifying competition and weak downstream demand

Shanghai Baosteel Packaging recently reported 23H1 results: Q2 revenue came to RMB2.03bn, up 2.35% yoy, with net profit at RMB66m, down 8.82% yoy, and ex-nonrecurring net profit at RMB61m, down 11.46% yoy. 23H1 revenue was RMB3.79bn, down 1.22% yoy, net profit was RMB127m, down 6.74% yoy, and ex-nonrecurring net profit was RMB120m, down 9.05% yoy. Revenue growth turned positive in Q2 but growth was slightly under pressure in H1 amid intensifying competition and fluctuating raw material prices, while macroeconomic factors dragged downstream demand lower than expected. Net cash flow generated by operating activities amounted to RMB690m in H1, climbing significantly by 343.49% yoy, mainly due to customers’ early repayments of RMB730m in the accounts receivable ABS program during the current year.

23H1兩片罐基本盤穩固,核心客戶銷售穩中有進。

分產品,23H1公司金屬飲料罐/包裝彩印鐵分別實現收入35.50/2.30億元,同比分別增長2.01%/下降33.92%,受益核心客戶銷售穩中有進,持續保持產銷量和份額的領先地位。包裝彩印鐵方面,主要受下游需求短期承壓拖累,收入同比下降。公司在金屬包裝領域長期深耕,提供快速響應及差異化產品,與可口可樂、百事、雪花、百威、嘉士伯、青島、王老吉、旺旺等國內外知名快消品牌核心客戶,建立了戰略合作關係。

Two-piece cans: solid fundamentals in H1; steady sales to core customers

By product category, Baosteel’s beverage cans/color-printed packaging metal generated revenue of RMB3.55bn/230m in 23H1, +2.01%/-33.92% yoy. With sales to core customers holding steady, the company maintained its leading position in terms of production, sales and market share. Color-printed packaging metal revenue fell yoy when short-term pressure dragged downstream demand. As an experienced metal packaging producer, Baosteel provides rapid response and product differentiation, and has formed strategic cooperative ties with core customers among well-known Chinese and foreign fast-moving consumer goods brands, including Coca-Cola, Pepsi, Snowflake, Budweiser, Carlsberg, Qingdao, Wong Lao Kat and Want Want.

持續推動境外業務發展,加快海外產能擴張。

2023年,公司推進“內外聯動”戰略實施,加快國內國外戰略佈局,新建項目與擴容項目,優化產品結構。在國內,公司在東部、南部、北部、中部、西部等各地均設立了生產基地。在海外,公司積極響應“一帶一路”倡議,立足國際化戰略,近期已專門成立海外事業部,加快推進國際化發展,跟隨品牌客戶開拓海外市場,發展新客戶。

Globalization drive: accelerating foreign market production capacity expansion

Baosteel promoted and rolled out an internal-external linkage strategy this year, accelerating its buildout in China and overseas, including new projects and expansion projects, while optimizing its product structure. In China, it established production bases in the east, south, north, central, west and other places. Internationally, it responded to the country’s Belt and Road initiative and recently established a dedicated global business department under its globalization strategy to drive export market development, explore foreign markets and brand customers, and develop new customers.

盈利能力穩中有升,費用管控有效。

盈利能力方面,23H1公司毛利率為9.16%,同增0.48pct,盈利水平提升,主要系原材料價格同比回落,23H1銷售/管理/研發/財務費用率分別為1.13%/2.66%/0.1%/0.17%,同比分別變動+0.2pct/+0.47pct/-0.12pct/-0.3pct,公司歸母淨利率為3.36%,同減0.2pct。

Steady growth in profitability and effective cost control

A granular look at profitability in 23H1 shows rising gross margin at 9.16%, up 0.48ppt yoy. The increase was mainly due to falling raw material prices on a yoy basis. Sales/ management/R&D/financial expense ratios arrived at 1.13/2.66/0.1/ 0.17% in 23H1, changing +0.2/+0.47/-0.12/-0.3ppt yoy. Net margin was 3.36%, down 0.2ppt yoy.

投資建議/Investment Ideas

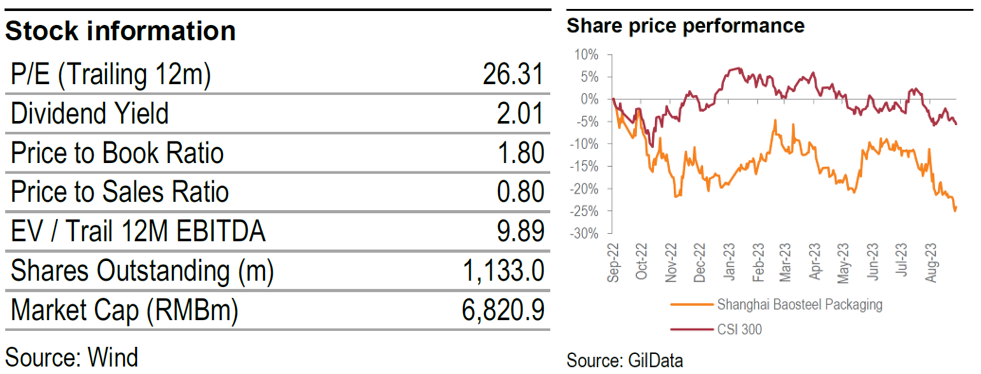

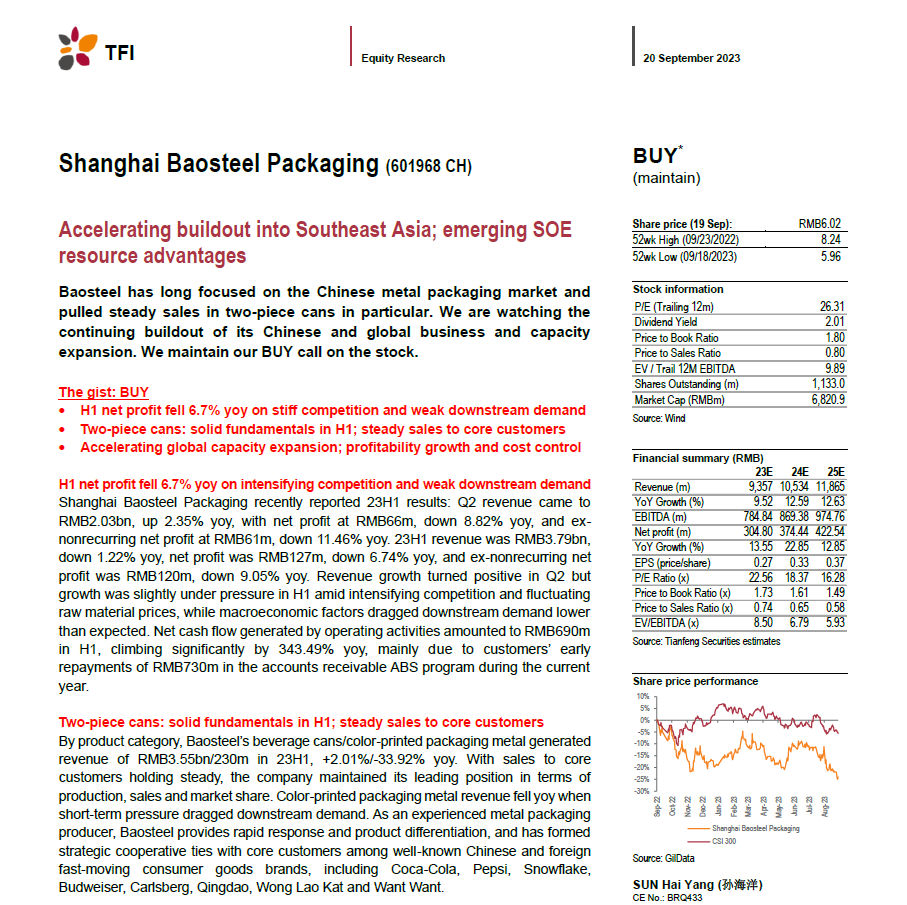

維持盈利預測,維持“買入”評級。

公司是國內金屬包裝龍頭企業,長期聚焦國內二片罐市場,近年來業務佈局持續擴張,我們預計公司2023-2025年EPS分別為0.27/0.33/0.37元/股,歸母淨利潤分別為3.05/3.74/4.23億元,同比增長13.6%/22.9%/12.9%,維持“買入”評級。

Forecast and risks

As a leading Chinese metal packaging producer, Baosteel has long focused on the domestic two-piece cans business and has expanded its business network in recent years. We forecast EPS at RMB0.27/0.33/0.37 and net profit at RMB305m/374m/423m in 2023/24/25E, up 13.6/22.9/12.9%. We maintain our BUY rating on the stock.

風險提示:巨集觀環境及政策變化風險;原材料價格大幅波動風險;下游需求承壓;客戶集中度較高風險。

Risks include: the impact of macro environment and policy changes; significant fluctuations in raw material prices; downstream demand pressures; and high customer concentration risks.

Email: equity@tfisec.com

TFI research report website:

(pls scan the QR code)

本文件由天風國際證券集團有限公司, 天風國際證券與期貨有限公司(證監會中央編號:BAV573)及天風國際資產管理有限公司(證監會中央編號:ASF056)(合稱“天風國際集團”)編制,所載資料可能以若干假設為基礎,僅供作非商業用途及參考之用途,會因經濟、市場及其他情況而隨時更改而毋須另行通知。任何媒體、網站或個人未經授權不得轉載、連結、轉貼或以其他方式複製發表本檔及任何內容。已獲授權者,在使用本檔或任何內容時必須注明稿件來源於天風國際集團,並承諾遵守相關法例及一切使用的國際慣例,不為任何非法目的或以任何非法方式使用本檔,違者將依法追究相關法律責任。本檔所引用之資料或資料可能得自協力廠商,天風國際集團將盡可能確認資料來源之可靠性,但天風國際集團並不對協力廠商所提供資料或資料之準確性負責。且天風國際集團不會就本檔所載任何資料、預測及/或意見的公平性、準確性、時限性、完整性或正確性,以及任何該等預測及/或意見所依據的基準作出任何明文或暗示的保證、陳述、擔保或承諾而負責或承擔任何法律責任。本檔中如有類似前瞻性陳述之內容,此等內容或陳述不得視為對任何將來表現之保證,且應注意實際情況或發展可能與該等陳述有重大落差。本檔並非及不應被視為邀約、招攬、邀請、建議買賣任何投資產品或投資決策之依據,亦不應被詮釋為專業意見。閱覽本文件的人士或在作出任何投資決策前,應完全瞭解其風險以及有關法律、賦稅及會計的特點及後果,並根據個人的情況決定投資是否切合個人的投資目標,以及能否承擔有關風險,必要時應尋求適當的專業意見。投資涉及風險。敬請投資者注意,證券及投資的價值可升亦可跌,過往的表現不一定可以預示日後的表現。在若干國家,傳閱及分派本檔的方式可能受法律或規例所限制。獲取本檔的人士須知悉及遵守該等限制。